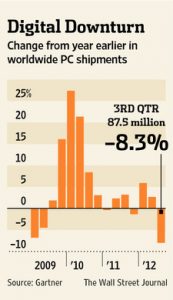

The surprising tailspin in personal computer sales this year raises an array of questions for tech investors going forward. Shipments of PCs, including laptops and netbooks, fell more than 8% in the third quarter, the sharpest decline since 2001, according to reports by IDC and Gartner.

First off, is the decline a short-term blip representing deferred purchases ahead of the late October launch of Windows 8 or a tipping point in which PCs start to fade permanently from the scene in this new era of mobile computing led by tablets and smartphones?

Intel CEO Paul Otellini, in lowering sales guidance for the chip leader, said on Oct. 16 that he expects PC sales in Q4 to grow at half the seasonal norm. (Intel faces other challenges beyond PC sales, as Christopher Mims outlines.) The comments helped push down the stocks of both Intel and IBM (IBM), which still has exposure to the PC market. IDC in latest outlook for the PC industry isn’t quite as bearish: “With the launch of Windows 8 in 4Q12, we expect shipment growth to return to mid-single digits in the fourth quarter and into next year.”

If the long-term secular decline of the PC market is truly underway, which companies most stand to benefit? Low cost Asian PC makers may have an edge, at least at the moment. Gartner recently crowned Lenovo (LNVGY) as the new king in PC manufacturing after it eclipsed Hewlett Packard (HPQ) in the third quarter. (IDC has HP still holding a slight market share edge.)

Preliminary Worldwide PC Vendor Unit Shipment Estimates for 3Q12 (Units)

| Company | 3Q12 Shipments | 3Q12 Market Share (%) | 3Q11 Shipments | 3Q11 Market Share (%) | 3Q12-3Q11 Growth (%) |

| Lenovo | 13,767,976 | 15.7 | 12,536,756 | 13.1 | 9.8 |

| HP | 13,550,761 | 15.5 | 16,217,987 | 17.0 | -16.4 |

| Dell | 9,216,638 | 10.5 | 10,676,513 | 11.2 | -13.7 |

| Acer Group | 8,633,267 | 9.9 | 9,616,572 | 10.1 | -10.2 |

| ASUS | 6,380,690 | 7.3 | 5,708,807 | 6.0 | 11.8 |

| Others | 35,954,748 | 41.1 | 40,683,666 | 42.6 | -11.6 |

| Total | 87,504,080 | 100.0 | 95,440,301 | 100.0 | -8.3 |

Note: Data includes desk-based PCs and mobile PCs, including mini-notebooks but not media tablets such as the iPad.

Source: Gartner (October 2012)