Hedge fund analyst Jonathan Moore ran an interesting experiment to see just how large Apple’s impact has been on the market rally over the past few years.

From Quora, in response to the question: Where would the S&P be today if you removed AAPL from the index?

* * *

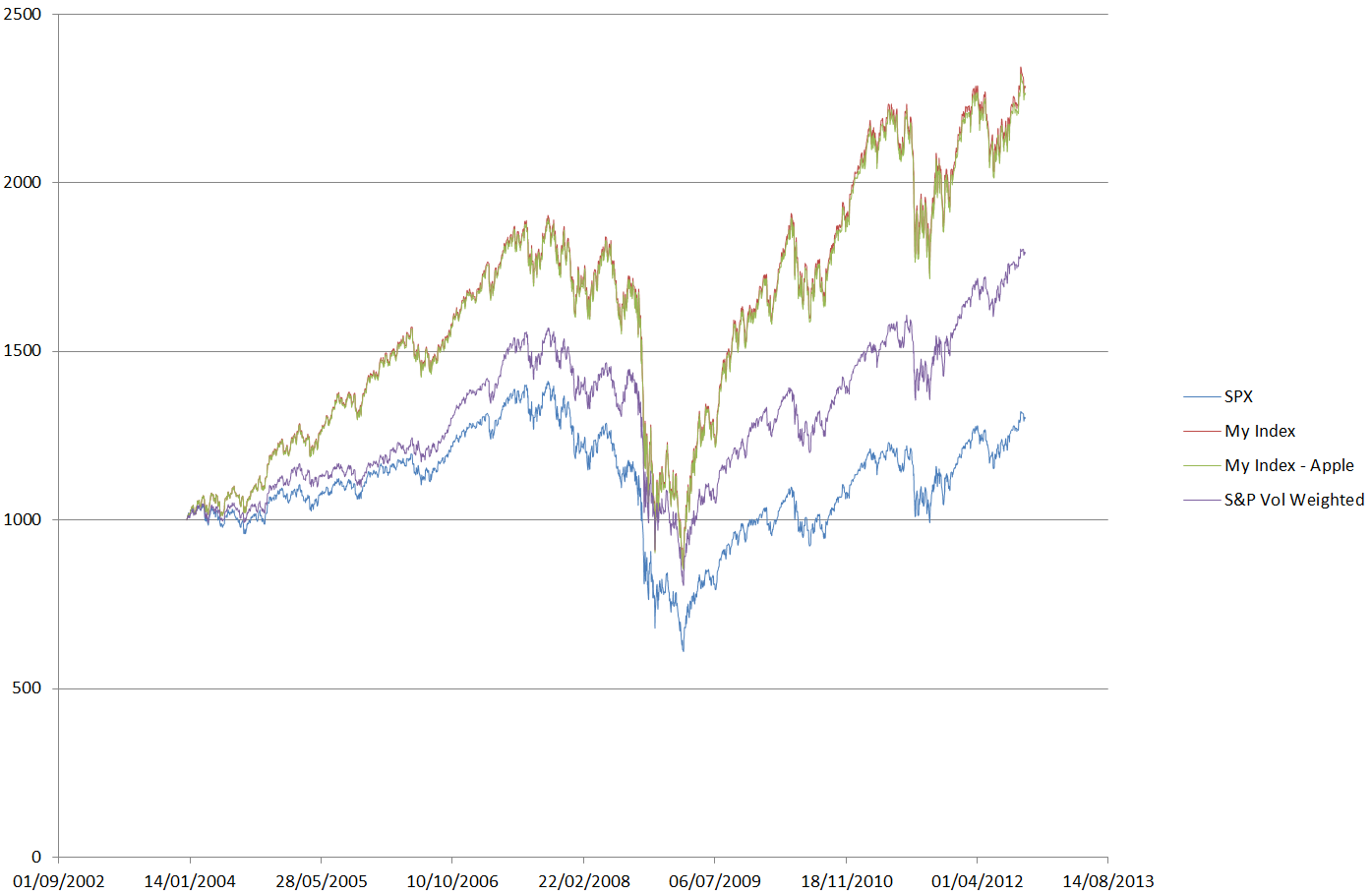

I’ve produced some charts that highlight the answer to this question in a basic manner. It also highlights a more important problem, but we can address that at the end.

I’ve built an index, equally weighted (i.e. each stock contributes the same amount to the index, not weighted by market cap or volatility), from the constituents of the S&P 500. I’ve removed any names that I can’t get full data series on from Jan 2004 (this is the time when Apple became significant, prior to which would not have made a huge difference in the performance of the S&P). This has left me with 427 names (including Apple). I’ve also presumed that the current composition of the S&P hasn’t changed over the past 8 years. This is obviously inaccurate, but for the purpose of this demonstration it’s not entirely necessary.

So my 427 names from Jan 2004, equally weighted (i.e. each stock has a % wgt of 1/427). Same stocks for the 8.5 year period to now, each stock has been rebalanced on a monthly basis to equal % wgts again. We’re presuming that the stocks in the S&P 500 are highly liquid and minimal trading costs associated with each rebalancing, and so ignoring slippage. Stock prices have been adjusted automatically for dividend reinvestment and prices have been adjusted to account for stock splits and other corporate events.

I’ve then built exactly the same index without Apple as a constituent (i.e. 426 names). The results are in the chart below (click to enlarge):

The results: The index including AAPL outperforms the index without AAPL by about 20 index points (~1%) – less than you thought? Perhaps. We’ve got a few fundamental flaws in my simulation, but the effect would be the same.

The S&P 500 is market cap weighted, where the biggest players in the index are also weighted the highest. So perhaps when AAPL became a significant player in the size of its market cap, it started to move the shape of the SPX a bit more, whereas in my simulation all the names have been assigned equal weights. This highlights quite a significant problem however. If AAPL, for example, now being the largest company in the world and a significant weight of the SPX, was to crash significantly because, and not too far fetched, their next generation iPhone was a complete flop, the S&P would suffer drastically.

It’s also surprising that my index methodology hugely outperforms the SPX – however you can see the volatility in mine is much higher also. This is a price one has to pay to have greater expected returns.

The answer to this is to have a volatility weighted index, where you weight each name in the population of stocks according to its historic volatility and its forward looking volatility which can be sought from the implied volatility across the vanilla options market. If anybody is interested in methodologies of risk weighted indices and would like more information then please get in touch – it’s quite an interesting area of finance.

See below for a simulation including a vol weighting methodology of the names in the S&P 500. As you can see we have a benefit of added returns on the basic SPX but with not much added volatility.

In answer to the question, removing AAPL from the S&P 500 would not make a significant difference, but would affect the performance. If it wasn’t a member then another stock would take its place and another name, Exxon, for example would become the stock with the highest weighting, and have a similar effect on the shape of the SPX. I think the more important question is what happens if we change the weighting methodology of market benchmark indices.