by Michael Tarsala

by Michael Tarsala

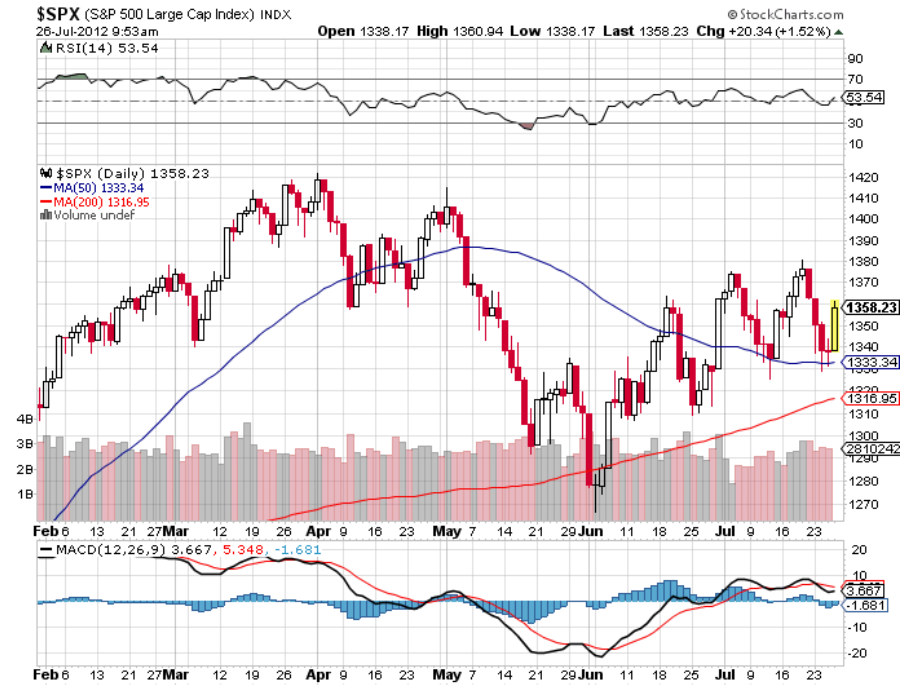

U.S. markets are on the rise Friday following the latest agreement to help fix the troubled euro zone.

Here are the details on the latest plan:

- Euro-zone rescue funds can now buy bonds directly from Spain and other troubled countries, in an effort to bring down yields.

- A single supervisor will now oversee the euro zone’s banks (instead of the group of 17 that are now in charge)

- The agreement also makes it possible for Italy and Ireland to request EU financial assistance

- Leaders agreed to move forward on a “time-bound road map” to form a “genuine” monetary union.

And here are some of the top links that explain the ramifications:

- It’s market rally time (Barrons)

- The Bank of International Sentiments will now take on more significance (Geneva Lunch)

- Morgan Stanley and BNY Mellon are among those skeptical of the deal; JP Morgan and Goldman say the euro currency will continue to fall (Business Insider)

- Goldman is now reportedly steering clients toward Spanish, Italian and Irish bonds (Zerohedge)

- It’s a lifeline for Spain and Italy (The Guardian)

- Spain and Italy won, Germany blinked, and a real euro zone banking union could now be in the cards (FT)

- A lot of liability details still must be worked out (WSJ blog)

Photo by: fdecomite