by Michael Tarsala

FutureAdvisor is a new investment portfolio advice and allocation service launched this week that is already among the breed of new financial supermarket killers.

The site is in beta, and already has seen a few reviews, including one in at PCMag.com that calls it the Mint.com of financial advice.

That’s a simplification, of course. But like Mint, you enter in your financial information, or you can import it from your institution. It will ask you some questions (about your retirement goals, your age, and your risk tolerance). From there, it helps you to think about your stock and bond asset allocation in the way an in-the-flesh adviser might go about the same process. And it helps you stay on track going forward.

Here’s what I like about it:

— It’s free. There are two levels of fee services (the most expensive is $200 a year) that provide you with better alerts and will allow one-on-one conversations with an adviser. But the core of the offering costs nada.

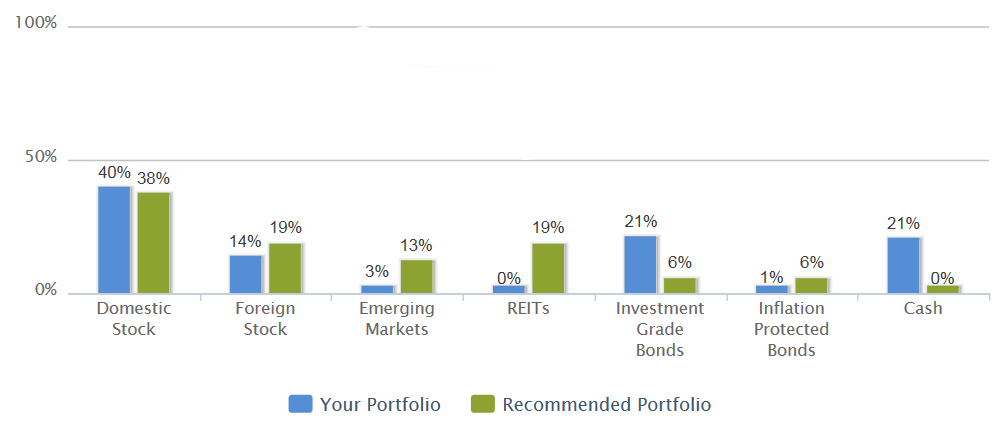

— The guidance is very visual and easy to understand. Go through the steps and you can very clearly see where you are versus your individualized “recommended” allocations. I entered in my account information and was able to figure out on my own that I had too much exposure to large-cap holdings. And see the chart below: It showed that I was short on emerging markets and TIPS (and supposedly REITs and cash).

— FutureAdvisor will help remind you to rebalance and to keep your account on track, which can increase returns over the long run.

— This part is really cool: It will recommend lower-cost, commission free alternatives, so you can avoid front-end and back-end loads.

— It is one of the only services I have seen that can help you with allocation choices within the available options in your particular 401k.

If there are drawbacks, here they are:

— FutureAdvisor has the same shortfall that characterizes this batch of new services, in that it’s just bonds and stocks. You won’t find allocation recommendations for commodities, managed futures and alternatives.

— There’s an implied industry-standard definition of diversification here. I would love to see a service that alerts you to strong correlations between seemingly very different investments in your account.

— When I used it, the system didn’t ask me any questions that I felt were relevant to any real estate holdings. As a result, I found it really off-base that the recommended portfolio had a 19% weighting in REITs (I would be interested to hear if others had the same experience).

Bottom line:

It’s a useful service. It’s in the spirit of leveling the financial playing field and doesn’t care about the size of your portfolio. Moreover, it can help you find lower-cost alternatives within your current strategy.

I will be checking in on FutureAdvisor in the coming months, as I count it among the growing number of alternatives to the financial supermarket.

This overview does not constitute an endorsement or recommendation of any financial service. Readers should do their own research to determine if any financial service is appropriate for their own needs.