Author: Charles Sizemore

Author: Charles Sizemore

Covestor models: Sizemore Investment Letter and Tactical ETF, Strategic Growth Allocation

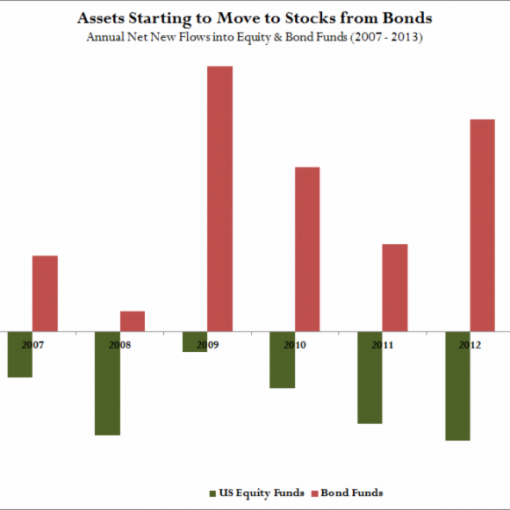

Barron’s ran a featured story by Kopin Tan in last weekend’s edition, entitled “Just Don’t Lose It ” and it was telling. Tan pointed out that even after the best January in well over a decade, investors weren’t embracing equities and neither were their financial advisors. Only 44% of financial advisors plan to increase their clients’ exposure to stocks in 2012, compared to 63% at this time last year.

I wasn’t particularly surprised to read these statistics. After all, the financial wealth of this country is dominated by the baby boomers, the largest and richest generation in history. The boomers lived through the biggest bull market in history (1982-2000), but they also saw a decade’s worth of returns go up in smoke in 2008. At this stage of their lives, they don’t feel like they can afford the risk of another meltdown. I get that. Even while I myself am bullish, I understand boomer risk aversion.

This is where it gets weird: it’s not the boomers that are skittish. It’s their children.

As Tan writes, “Risk aversion is particularly acute among ‘Generation Y’ investors born after 1980, who have decades to go before they retire but are especially reluctant to invest. As a result, this cohort allocates roughly 30% of their money on average to cash, more than any other age group.”

Far from being the reckless risk takers that youth are wont to be, this generation is showing a level of risk aversion I might have expected from an elderly retiree that lived through the Great Depression. Fully 40% of the Gen Y investors said they would “never feel comfortable investing in the stock market.”

I can’t say that I don’t understand the general squeamishness with equities these days. The same Barron’s article noted that the average daily move in the S&P 500 was 1.44% in the second half of 2011. That’s nearly double the 0.75% average that has prevailed since 1928.

Still, when I see this kind of pervasive fear in the market, particularly among those who should normally be aggressive, I can’t help but be bullish. Bearishness has reached the level of the absurd.

For the past two years, I’ve advocated investing in high-quality, dividend-paying stocks, and I continue to recommend these as the bedrock of a portfolio. The alternatives for most conservative investors are sparse. Cash pays nothing in interest, and most bonds pay only slightly more. Meanwhile, the cash levels of U.S. companies are at an all-time high, and dividend payouts are hovering near all-time lows. Conservative investors can assemble a portfolio of stocks that will out-yield a bond portfolio today and that will almost certainly benefit from rising dividends in the years to come.

For more aggressive investors, the time has come to “risk up” by buying the sectors that took the biggest beating in 2011. I am bullish on Europe (see ” Going Long on Two Euro Stocks “) and emerging markets (see ” Emerging Markets Will Make a Comeback in 2012 “). And while I don’t make a habit of recommending commodities, I would have to add commodities to my list of cyclical sectors likely to do well in 2012.