Author: Bill Deshurko, 401 Advisor

Author: Bill Deshurko, 401 Advisor

Covestor model: Dividend and Income Plus

Disclosure: Long all stocks mentioned

In the last column I wrote about Annaly Capital Management [NLY], and how one can try to limit the risk of owning the stock if you want the nice 15% dividend yield. One way is to identify the market fundamentals that would negatively impact the stock, and be prepared to sell. Another is to hedge your risks with other stocks that will likely behave differently in various economic scenarios.

Let’s use Annaly as an example of how to hedge the economic risks of a stock with other stocks from different sectors.

First, let’s be clear about the difference between diversification and hedging. An example of diversifying a portfolio would be buying three utility stocks to diversify your risk among utility stocks. Hedging a utility stock, on the other hand, could mean buying a commodity stock that would benefit from inflation – an environment that would likely hurt utility earnings.

Annaly is classified as a mortgage REIT. So some of the risks and hedge positions I currently own are:

Narrowing Credit Spreads: High yield corporate bonds, through the junk bond ETF [JNK]

Slowing Economy: Utility stocks, American Electric Power Company [AEP]

Flattening yield curve, with rising short rates: Commodities, Southern Copper [SCCO] and/or Penn West Petroleum [PWE]

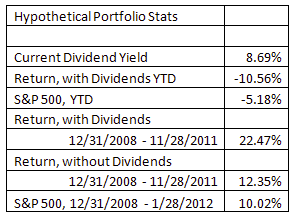

Let’s assume an equal dollar weighting of these five securities and see what we would have (Data from MarketWatch as of 11/29/2011):

However, on the plus side, since 12/31/2008 our little portfolio has nearly doubled the average annual return of the S&P 500 with dividends reinvested. More interesting to me and many of my clients, without dividends this portfolio has matched the S&P 500’s return over the same time period. In other words, an investor could have realized S&P 500-like capital gains, while receiving all those nice dividends in cash.