Author: J. Stephen Castellano, Ascendere Associates

Covestor model: Systematic Long-Only

Disclosure: Long TRW, FCX, RES, TER, SNDK, AMD, EWBC, COH, WSM

Proxies that we use to measure cash flow growth, ROIC and fundamental quality continue to improve for many companies. We think this is a great anecdotal sign for the market in general, and despite recent market volatility and some strategist calls for a top, we think the market will end up higher by the end of the year.

As a result, there are now 32 companies in our model long portfolio selected from an eligible group of 82 stocks, up from 25 stocks selected from an eligible group of 65 stocks last month. We are closing 7 positions, opening 14 positions and rebalancing 18 positions.

Energy, Healthcare and Technology Showing Strong Fundamental Momentum

Very interesting is the surge in the number of high-quality technology companies – there are now seventeen high-quality stocks in our model, up from nine last month. Another sector that gets our attention is healthcare – there are now five high-quality stocks, up from only one last month.

This could indicate continued favorable prospects for tech stocks and perhaps renewed interest and sustained momentum in a number of healthcare stocks going forward.

Also, the number of eligible high-quality energy companies is now seven, up from three last month.

Highest Ranking Stocks in the Long Model Portfolio

5 out of 32 stocks in the new long model get the highest possible scores in the key factors that we measure: 1) Relative Value; 2) Operating Momentum; 3) Analyst Revision Momentum; and 4) Fundamental Quality. They include the following:

TRW Automotive Holdings Company (TRW)

Freeport McMoRan Copper & Gold (FCX)

RPC Inc. (RES)

Teradyne Inc. (TER)

SanDisk Corp. (SNDK)

Controversial Stocks

There are a few “controversial” names in the long models this month. The first is Advanced Micro Devices (AMD), a stock that has been written off by many investors as a has-been player in processor and graphics chips. While Intel (INTC) made it to our eligible list, we think that on a month-to-month basis, AMD has better price appreciation potential and therefore added it to our high-turnover model portfolio strategy. A catalyst for the stock may be the new addition of a reputable CEO.

Another “controversial” selection is East West Bancorp (EWBC). This stock has been a stellar performer since first being added to our model long portfolios. It just recently reported an outstanding 4Q10, and a high-number of sell side analysts have since raised estimates and price targets for the company. This selection is controversial because it has moved beyond growth-at-a-reasonable-price (GARP) territory and into pure growth, as we define it. We score it a poor 2 out of 5 for Relative Value, but it scores 5 in other key categories such as Operating Momentum, Analyst Revision Momentum and Fundamental Quality. We normally rebalance out stocks that become too pricy by our measures, but we have noticed over the years that 1,5,5,5 and 2,5,5,5 stocks sometimes keep growing to absurd valuations. Such examples include Apple Inc. (AAPL), Netflix, Inc. (NFLX) and Chipotle Mexican Grill, Inc. (CMG). We doubt that EWBC is the next financial sector Netflix, but on the other hand we think it could work in our favor if we keep EWBC a bit longer.

Our approach to stock selection suggested that we get rid of Williams-Sonoma Inc. (WSM) and replace it with Coach, Inc. (COH). However, there is nothing fundamentally wrong with WSM; it was just beat out slightly by COH. The last time we deferred completely to a non-fundamental measure to our model portfolio selection strategy the stock surged more than 20%. We are not making the same mistake this time and so are adding COH to our existing WSM position.

We are reluctantly getting rid of Huntsman Corp (HUN) based on relative valuation concerns. Like EWBC, it scores a 2 for relative value, but does not come in at the top for other key measures, so it gets rebalanced out. On any price pullback it could be relatively attractive again so we would keep a close eye on this one.

We are also a bit reluctant to get rid of Dover Corp (DOV) after a stellar 4Q10 report. However, on a relative basis it looks a bit weak on value and quality. It is quite possible as more companies report 4Q10 results it could find itself back within the top rankings, so we would watch this one as well. Sometimes rankings themselves can be a bit volatile, especially during earnings season. A good example was our move to sell Union Pacific Corporation (UNP) and CSX Corp. (CSX) on 12/31/2010, only to be adding them back on 1/31/2011.

Dollar Neutral Strategy

Shorting low-quality stocks over the last few months has not worked very well. This is because on an absolute basis there are not very many poor fundamental companies. Virtually every company that has remained solvent has taken massive steps to improve cash flow growth and operating efficiency. In addition, as economic prospects continue to improve, these relatively unattractive companies are reporting better than expected results relative to very depressed estimates and valuations. This has caused a number of “low-quality” stocks to outperform “high-quality” stocks. Investors looking to implement a hedged strategy may therefore do better to short broad indices as opposed to specific stocks or groups.

The aggressive investor may also want to focus on “low-quality” stocks as potential long ideas. Adobe Systems Inc.’s (ADBE) recent price move is a good example of what can happen to “low-quality” stocks that significantly beat estimates and raise guidance.

Summary

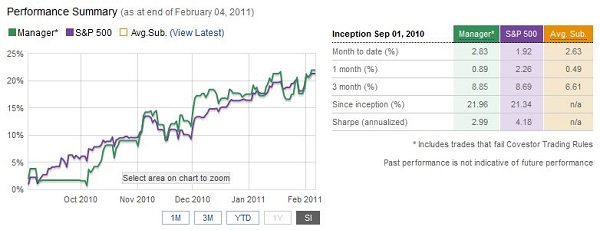

Adhering to a systematic strategy, even if only as a partial guide to generating individual stock ideas, can in our opinion greatly enhance the odds of beating any given benchmark.