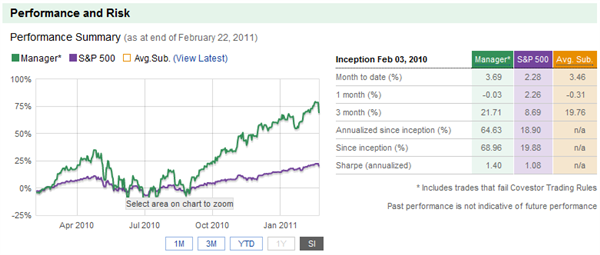

For his Opportunistic Arbitrage portfolio, Covestor model manager Mark Holder looks for small- to mid-cap companies involved in a major corporate transaction such as an IPO or spinoff, or simply operating in “beaten down sectors.” Mark is a CPA educated at the University of Tulsa. He aims for a “well diversified group of 15 – 20 stocks with mainly long exposure.” Current top holdings are Massey Energy Co (MEE), AerCap Holdings NV (AER) and Terex Corp (TEX).

* See important disclosures

* See important disclosures

On February 18, Mark added ICICI Bank Ltd (NYSE:IBN) to the model. The Wall Street Journal reported:

India’s ICICI Bank Ltd. Wednesday [2/23] said it will hike its key lending rate and some of its deposit rates with effect from Thursday. India’s largest private sector bank by assets is among the last of the lenders to raise interest rates after sticky inflation led the central bank to resume its rate tightening.

…

Though Indian banks have shifted to the more transparent base rate system, a large number of loans remain linked to the benchmark prime lending rate.

On his show, Mad Money, Jim Cramer said that he would “never own a bank stock when they’re tightening rates. That one is a sell, sell, sell.”

IBN closed down 1.3% on 2/23/11, finishing at $43.97.

Sources:

“ICICI Bank to Raise Rates” Nupur Acharya, Wall Street Journal 2/23/2011 http://online.wsj.com/article/SB10001424052748703775704576162133696035022.html?ru=yahoo&mod=yahoo_hs

“‘Mad Money Lightening Round’: Take a Bite of Apple” Scott Rutt, The Street 02/22/11 https://www.thestreet.com/_yahoo/story/11018050/1/mad-money-lightning-round-take-a-bite-of-apple.html?cm_ven=YAHOO&cm_cat=FREE&cm_ite=NA