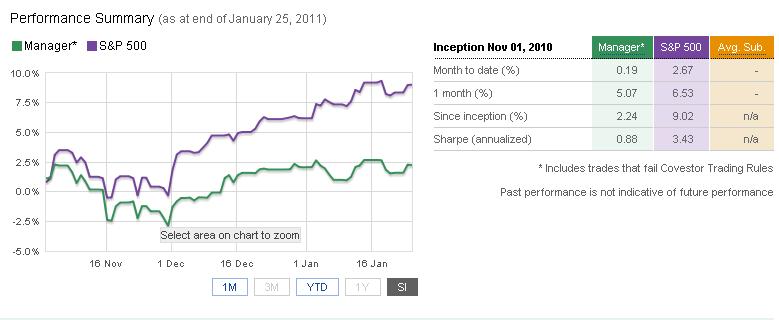

Analytic Investment’s Dividend model holds 50 dividend stocks at a time. The goal of the model, along with producing income from dividends, is to outperform the S&P 500 while creating a portfolio that is less volatile than the index. In its January 2011 Investment Report, Analytic Investment had this to say about the model’s performance:

Analytic Investment’s Dividend model holds 50 dividend stocks at a time. The goal of the model, along with producing income from dividends, is to outperform the S&P 500 while creating a portfolio that is less volatile than the index. In its January 2011 Investment Report, Analytic Investment had this to say about the model’s performance:

Dividend model underperformed in December primarily due to the concern for rising interest rates globally, which makes dividend-paying stocks less attractive in the short term. Regardless their monthly performance fluctuation, buying short-term unloved undervalued investments and investing in quality dividend stocks are proven long-term alpha generation strategies, so the algorithms remain unchanged for both models.

The top holding in the model is Aqua America (NYSE: WTR). WTR provides both wastewater and drinking water services for the residents of 14 states. In December the company’s Texas subsidiary acquired the assets of Gray Utility, which serves about 6,300 people along the Gulf Coast. This purchase was part of the company’s, “growth-through-acquisition” strategy to extend its presence in fast growing states like Texas. WTR was recently featured on 24/7 Wall St.’s, “The Best Water Stock for 2011” list but not everyone agrees with that assessment, as New Low Observer suggested that investors sell WTR in December. On January 26th, CNN Money showed WTR with a 2.63 percent dividend yield. On the same day, Yahoo Finance reported WTR’s 52-week range as $16.45 – $23.79.

If you’re interested in a high dividend stock model, check out Analytic Investment’s Dividend on Covestor.