Social media, repetitive media, high-frequency trading and more… Hedge Fund is betting that Twitter is Wall Street’s Crystal Ball – Robert Andrews, PaidContent.org Sharp rise in financial pros using social media for news – IR Web Report You are reading the same article over and over again – Joshua Brown, […]

For his Technical Swing portfolio, Covestor model manager Michael Arold uses technical indicators in conjunction with a discretionary view of trending stocks and sectors to capture profits in short term price swings. Current top holdings include ProShares UltraPro Short S&P 500 (SPXU), Cameco Corp (CCJ) and iShares Silver Trust (SLV). On March 22, […]

Behavioural Finance Investment (BFI) Advisors eschews strict fundamental and technical investing in favor of a behavioral approach. Since 2009, the group, led by Dr. S.J. Feldman, Ricardo Vernazza, Philip Braun and Chris Panon, has been modeling sentiment in an attempt to quantify the extent of irrational sentiment priced into the […]

ASB Investment Management is the equity and fixed income management division of ASB Capital Management. Offices are in Washington, D.C. and Chicago. With $6.3 billion under management as of January 2011, ASB Investment Management has a long record of managing equity and fixed income. ASB’s new Covestor model, Large Cap […]

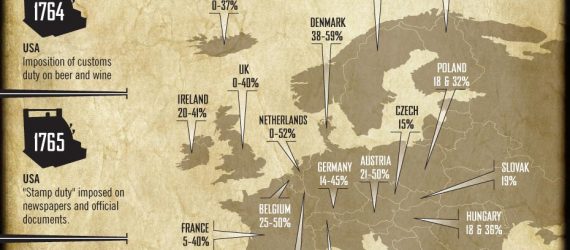

CreditLoan presents this fascinating infographic comparing both corporate and personal tax rates around the world. Now we wait for an infographic showing the mass migration from Denmark to Switzerland!

For his Opportunistic Value portfolio, Covestor model manager Hengfu Hsu uses proprietary computer algorithms to capture equity mispricing opportunities in mid- and small-cap stocks. Current top holdings include Mercer International (MERC), PC Mall (MALL) and Omega Protein (OME). On March 14, Hsu added to his position in PC Mall (MALL), a direct marketer of technology […]

Zack Miller is Covestor’s Head of Business Development. In his podcast below, Zack speaks with Theresa Hamacher and Bob Pozen, authors of a new book on the mutual fund industry. Mutual funds have introduced millions of Americans to investing in the stock market. While their popularity and usage may have […]

For his Cash Flow portfolio, Covestor model manager Jose Betancourt conducts fundamental analysis to find companies with high free cash flow and negative net debt. Current top holdings include ChinaCast Education (CAST), Tellabs (TLAB) and Theragenics (TGX). On March 14, Betancourt added a new position in Tellabs (TLAB), which is engaged in designing and […]

Electronics contract manufacturer Jabil Circuit (NYSE: JBL) reported late Tuesday (3/22) that net income jumped 86 percent in its second fiscal quarter of 2011 to $55.4 million, or 25 cents a share, compared to $29.8 million, or 14 cents a share, in the year-ago period. Revenue increased 31 percent to […]

Private Equity investor Chris Douvos has been watching a lot of Indiana Jones movies with his kid. In his current fave, The Last Crusade, Douvos finds in the three tests Indy has to pass to obtain the Holy Grail some essential lessons for investors: Challenge #1: The Breath of God… […]

Author: Michael Arold Model: Technical Swing Disclosure: Long CCJ Cameco Corp. (CCJ) is the world’s largest uranium mining company and obviously affected by the nuclear catastrophe in Japan. The stock declined over 30% during the recent market sell-off. However, I believe that the company was overly punished and that CCJ […]

For her International Yield portfolio, Covestor model manager Vivian Lewis focuses on high yielding closed end funds, preferred shares and common shares of companies that reside physically outside of the United States. Current top holdings include Ecopetrol SA (EC), Templeton Emerging Markets Income Fund (TEI) and Ultrapar Participacoes SA (UGP). On March […]