For her International Yield portfolio, Covestor model manager Vivian Lewis focuses on high yielding closed end funds, preferred shares and common shares of companies that reside physically outside of the United States. Current top holdings include Ecopetrol SA (EC), Templeton Emerging Markets Income Fund (TEI) and Ultrapar Participacoes SA (UGP). On March […]

Frank Voisin

Author: James Hofmann Model: Dividend Growth Disclosure: Long T Over the weekend AT&T (NYSE: T) the second largest wireless carrier in the US announced plans to buy T-Mobile the fourth largest carrier in the US for $39 billion. The combined company will be the largest provider in the US surpassing […]

For the Pure Growth portfolio, Covestor model manager BSG&L focuses on companies with 15% ROE, good liquidity and a PEG ratio of less than 1.25. Current top holdings include Caterpillar (CAT), Linn Energy (LINE) and Peabody Energy (BTU). On March 17, BSG&L added a position in Continental Resources (CLR), an independent crude oil and […]

For the Pure Growth portfolio, Covestor model manager BSG&L focuses on companies with 15% ROE, good liquidity and a PEG ratio of less than 1.25. Current top holdings include Caterpillar (CAT), Linn Energy (LINE) and Peabody Energy (BTU). On March 17, BSG&L added a position in EMC Corporation (EMC), which develops, delivers and supports […]

For his Biotech and Medtech portfolio, Covestor model manager Jeremy Zhou invests in the US healthcare industry. Current top holdings include Teva Pharmaceutical Industries (TEVA), Transcept Pharmaceuticals (TSPT) and Biodel (BIOD). On March 16, Zhou added a position in Dendreon Corporation (DNDN), a biotechnology company focused on the discovery, development and commercialization of therapeutics […]

Author: The Coe Report Model: Market Timing Technicals Disclosure: None Technology has shown underperformance for several weeks and that is becoming a concern as it is now threatening the long-term bullish case. The ratio of the NASDAQ 100 (NDX) versus the S&P 500 (SPX) has pulled back to the 200-day […]

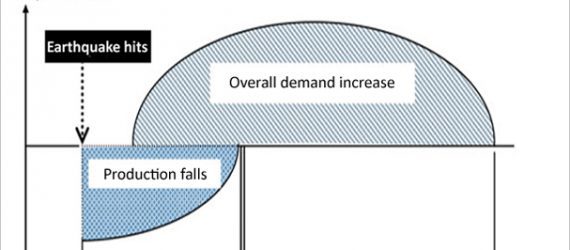

Clusterstock created this interesting chart from a Barclays report about the coming reconstruction boom in Japan, which concludes that short-term GDP declines will ultimately give way to faster GDP growth. (Click image for full size) What companies will profit from the reconstruction boom? According to Scott Rothbort of StockPickr, there […]

The New York Times created this infographic about exploiting the local grocery store’s salad bar for the most value (click for full size): Sources: “How to Beat the Salad Bar” Nate Silver. New York Times, 3/17/11. https://www.nytimes.com/2011/03/20/magazine/mag-20Subversion-t.html?_r=2

Author: Darren Taylor Model: Top 5 Screener Disclosure: None The Top Five Screener model is long only. We invest in what we believe are undervalued stocks and sell only when better opportunities arrive. Because of this, the model normally maintains some cash to take advantage of pullbacks. Despite all the […]

Author: CJ Brott, Capital Ideas Model: Macro Plus Income Disclosure: Long KWK Darden Family Interests announced Thursday (3/17) that they have determined not to pursue a take-private transaction announced last October. Although Quicksilver Resources Inc (KWK) is down 3.56% on 578% of average daily volume (as of end of day, […]

Author: Robert Gay, GEARS Model: Luxury Liner Disclosure: Long LYTS, COHU, VECO, NSM With the most recent quarterly financial statements from the large majority of the capital value of the stock market now accounted for, I see a continued powerful and now leveraged acceleration in corporate wealth. The capital-weighted average sales […]

For those who may not be familiar, Footnoted is a website devoted to corporate SEC filings. Michelle Leder and her staff dig through filings for interesting disclosures amongst the corporate boilerplate. Today she posted about how corporations have been including the Japanese disaster in their filings. There have been 48 […]