Bloomberg has an IPO index that tracks the performance of US IPOs over their first 12 months as publicly traded companies. The cap-weighted index is meant to gauge the collective performance of IPOs over time. Below is a look at the performance of the Bloomberg IPO index so far in 2012. As shown, the index is currently down 3.1% year to date versus the S&P 500’s gain of 12.9%. The main reason for the underperformance of the IPO index in 2012 should be easy to guess — Facebook (FB). As shown below, IPOs were outperforming the S&P 500 handily in the first quarter, but once Facebook went public in May, the index lost ground and has not been able to catch back up.

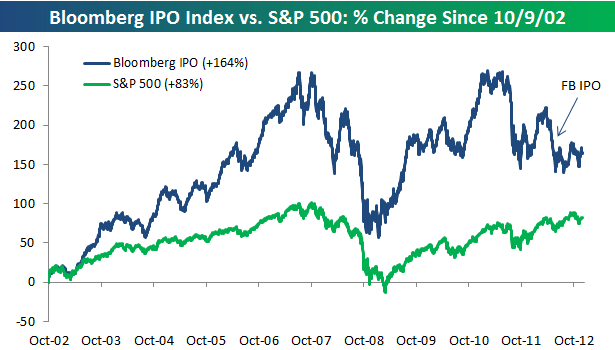

The Bloomberg IPO index is still outperforming the S&P 500 on a longer term basis, however. Over the last ten years, the IPO index is up 164% versus the S&P 500’s gain of 83%.

Data and charts: Bespoke Investment Group