Author: Charles Sizemore

Author: Charles Sizemore

Covestor models: Sizemore Investment Letter and Tactical ETF

Disclosure: Long TKC, ECON

As I wrote last week, I have emerging markets on my mind because — at least through the first of the year — I’m living in one.

I’m writing this article from the bustling Peruvian farming and ranching town of Paijan, where, between attempting to follow the markets from afar and chasing after my two-year old son, I’ve managed to find a little time to ride some of Peru’s famed Paso horses. (Tiny Paijan is actually well known among Peruvian horse aficionados around the world by virtue of being home to the Vasquez family. If you’ve never heard of Anibal Vasquez Montoya or his sons Anibal and Lucho, then you have no business calling yourself an aficionado.)

In my last article, I wrote that 2012 would be a comeback year for emerging markets and I want to reiterate that point today. But before you put in an order for your favorite emerging market country ETF, there is one little piece of homework you should do — check the sector allocation. To illustrate, I’ll use the example of my home for the holidays, Peru.

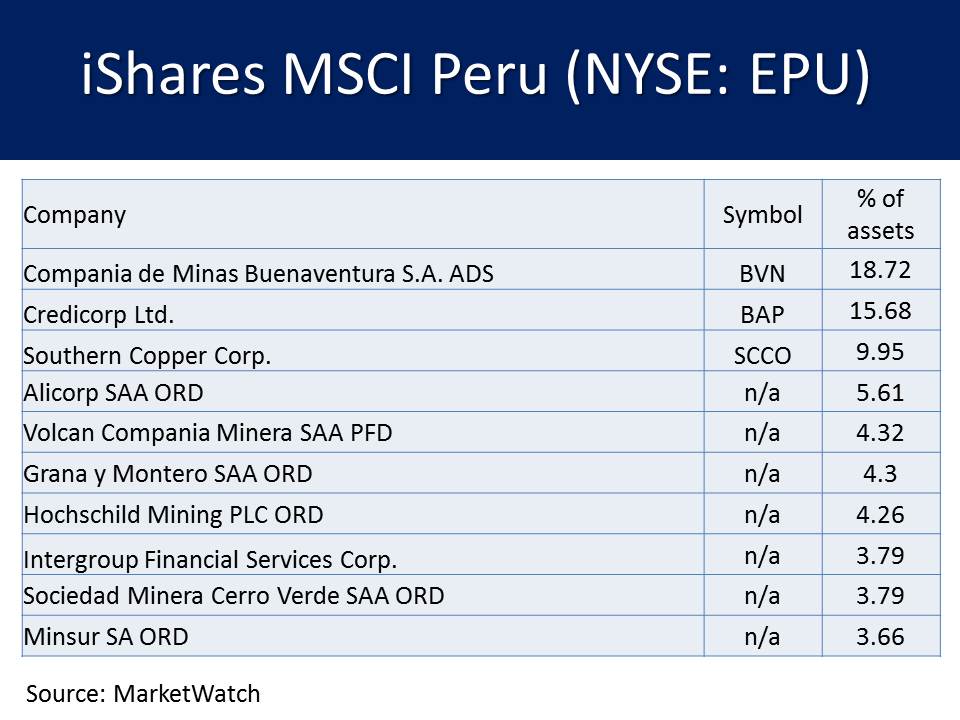

Taking a look at the holdings of the iShares MSCI Peru ETF (EPU), we see a fund that is, shall we say, a little less than diversified. 53% of the ETF’s market cap is in basic materials, and 19% is invested in one stock alone — gold miner Compania de Minas Buenaventura (BVN) .

Buenaventura is an excellent miner, of course. And with the political risk surrounding Ollanta Humala (the formerly-leftist new president of Peru) receding, the Peruvian mining sector may enjoy a great 2012. But the company’s business model is driven by the global price of gold and by the regulatory and tax regime of Peru. It has little to do with the health of the domestic consumer economy, which is the source of my optimism.

The bottom line on the iShares MSCI Peru ETF is that it is a great way to get targeted exposure to the South American mining sector but a pretty lousy way to get access to the spending power of the new Peruvian middle class.

Another example would be the iShares MSCI Turkey ETF (TUR). Though Turkey has little in the way of mines, it has quite a bit in the way of banks. Nearly half of the ETF is invested in the financial sector (see holdings).

I’m actually quite bullish on Turkish stocks. In fact, I was bullish enough on Turkey to make Turkish mobile telephone giant Turkcell TKC -2.01% my entry in InvestorPlace’s “10 Stocks for 2012” contest. I’m also fairly bullish on Turkish banks. But before you buy shares of the Turkey ETF, you need to understand what it is you’re buying.

Broader emerging market ETFs are better diversified, but not as much as you might think. The popular iShares Emerging Markets ETF (EEM) is noteworthy for being concentrated in financials, materials, and energy — sectors driven more by global trends than by emerging market trends — and having comparatively little exposure to consumer-oriented stocks and telecom.

WisdomTree’s broad emerging market offering — the WisdomTree Emerging Markets Equity (DEM) — makes up for EEM’s shortcomings in telecom by taking a 21 percent allocation to the sector but also has an even higher percentage than EEM in financials at 25 percent.

For investors wanting a one-stop ETF, the EG Shares Emerging Market Consumer ETF (ECON) remains my favorite. It is a diversified basket of emerging market companies that sell to their domestic consumers. More adventurous investors could make ECON the core of an emerging market portfolio that also included country-specific ETFs that are poised to do well in the coming year. In addition to Turkey, the iShares FTSE China (FXI) and iShares MSCI Indonesia (EIDO) are worth considering in 2012.

Wishing you all a próspero año nuevo from Peru.