Author: TG Asset Management

Author: TG Asset Management

Covestor model: Tactical All Asset

Disclosure: None

All asset allocation decisions require comparisons of relative and absolute value to decide whether an allocation to one asset class versus another should be made.

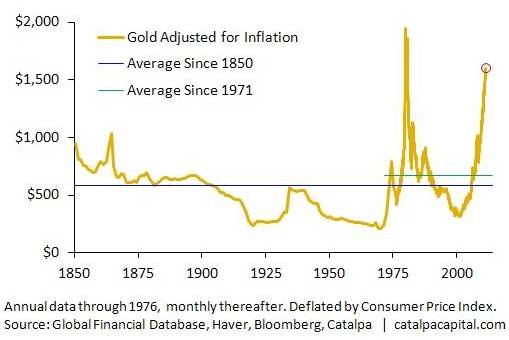

Given the relative and absolute value of gold today as illustrated below, one must consider the low future return expectations of gold and the greater possibility of major losses going forward.

- The real return from gold over the long run is about the same as a US T-Bill but with a whole lot more volatility.

- Gold has surged over 500% in just ten years and recently touched a new all-time high of $1,601 an ounce. Adjusted for inflation, the price of gold was even higher back in 1980 when it reached nearly $2,000 in today’s dollars, suggesting this rally could have more to go.

- Gold would need to drop nearly 70% in dollar terms to reach its historic inflation-adjusted average.

Source:

Catalpacapital.com, using data from Global Financial Database, Haver, Bloomberg