Model manager Sean Hannon added two new positions to his RIG), an offshore drilling contractor. The company’s quarter two results have shown weakened revenues, reduced income and a higher earnings per share than the previous quarter. The company has a low price to earnings ratio and its stock price seemed to be rising steadily in early August.

Hannon also added Research In Motion Ltd (NASDAQ:RIMM) to the model. RIMM is the designer and manufacturer of the BlackBerry smartphone. Over the past four years the company has posted impressively growing revenues and income. Their earnings per share have grown also. They have a relatively high price to earnings ratio which may mean that they are overbought.

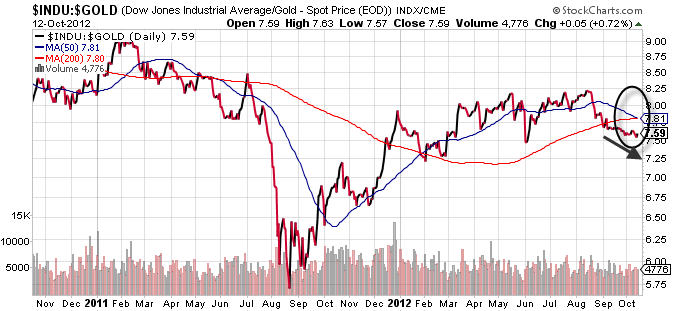

In his Technical Swing model, manager Michael Arold uses market momentum and technical indicators to make short-term investments that capitalize on market swings. This week, Arold bought ProShares Ultra Gold (UGL), an ETF designed to mirror 200% of the performance of gold bullion. The underlying assets of the fund have economic characteristics anticipated to deliver twice the performance of the SPDR GLD. At the time this post was written, the fund was trading at a premium to NAV.

Arold also added KKR Financial Holdings LLC (NYSE:KFN). KFN is a finance company that specializes in global alternative asset management. The company released their quarter two financials on August 4th and went from a closing price of $8.10 on August 3rd to $8.90 on August 9th. Their financial results showed a reduced net income in the second quarter but one that exceeded the net income of quarters two and three in 2009.