Author: Tom Konrad

Author: Tom Konrad

Covestor model: Energy Efficiency

Disclosures: Long NFI-UN, CVT, COMV, ENOC, RPG, MGMXF, AXPW, NGLPF, ABTG, RKWBF.

Buying opportunities return to clean energy.

Two years ago I had a problem. In the universe of clean energy stocks I watch, I could not find any that I thought were good values. So I wrote an article saying “We’re near the peak.”

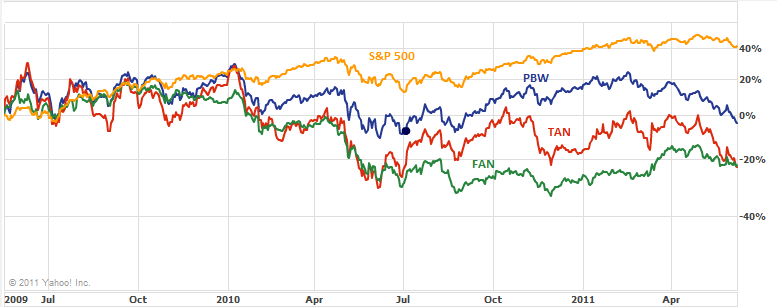

If you had been comparing that call to the performance of the broad stock market since then, you would have to conclude that I was ludicrously wrong. The S&P 500 is up about 40% since then.

If on the other hand, you’d been watching clean energy stocks, you would have found that the overall trend has been flat to down. The PowerShares WilderHill Clean Energy (ETF) (NYSE: PBW) has basically been flat since then, while solar (Claymore/MAC Global Solar Index (ETF) (NYSE: TAN)) and wind (First Trust Global Wind Energy (ETF) (NYSE: FAN)) ETFs are each down about 20%.

I mention all this because I notice something new, that hasn’t happened for almost two years: I’m again finding clean energy stocks that I think are bargains. I think the sector and the market as a whole still have a lot of room to fall, but I’m encouraged to finally have companies to write about that I think are worth buying again.

Here are ten I’ve been buying, in no particular order.

1. New Flyer Industries (TSE: NFI-UN) a bus manufacturer. See article: Questions About Dividend Spook New Flyer Investors. Why I’m Buying.

2. CVTech Group (TSE: CVT) a transmission and efficient vehicle company. See article: The Best Peak Oil Investments Meet the Strong Grid.

3-5. Comverge (NASDAQ: COMV), EnerNOC (NASDAQ: ENOC), which are demand response companies, and Ram Power Corp. (TSE: RPG), a geothermal developer. See article: Ten Clean Energy Stocks for 2011: Buying Opportunities.

6. Alterra Power Corp. (PINK: MGMXF) is a geothermal and hydropower developer, see: The Magma/Plutonic Merger.

7. Axion Power International (OTC: AXPW) is a developer and manufacturer of PbC batteries. See: An Elephant Hunter Explains Market Dynamics

8. Nevada Geothermal Power (OTC: NGLPF), another geothermal pick. See: Blue Mountain Disappoints; Nevada Geothermal Power Looks Like a Takeover Target

9. Ambient Corp. (OTC: ABTG) a smart grid stock. See article: A Profitable Smart Grid Penny Stock Aims for a NASDAQ Listing

10. Rockwool International A/S B (PINK: RKWBF) an international insulation company. No article yet, but it’s mentioned here: Canadian Insulation Companies Likely to Benefit from Next Budget.

Four of these stocks (Comverge, EnerNOC, Ram Power, and Nevada Geothermal) were part of my annual New Year’s list of ten clean energy stocks I liked. At the time, I only owned the two Geothermal stocks, because I was having trouble finding anything I thought was a good value. That original list has been doing horribly so far this year, in large part because of the dismal performance of these four stocks and that of American Superconductor (NASDAQ: AMSC). I’ve been following AMSC’s very real problems closely, discussing the refusal of their main customer Sinovel (601558.SS) to accept shipments, the likely reasons behind that refusal, and attempting to value the AMSC under the assumption that Sinovel will resume accepting shipments, but not at their former pace and without future growth.

Ram Power and Nevada Geothermal also had real problems at their geothermal projects, but I feel that the market has vastly overreacted to both, making the pair bargains by almost any measure, and also potential takeover targets in my estimation. If I were picking my ten stocks today, it would be the list above, with the three Geothermal companies underweighted relative to the rest to avoid putting too much money into one tiny sector.

All in all, it feels good not to be sitting on the sidelines anymore. Blood is on the streets for a lot of decent renewable energy and energy efficiency stocks, and experienced market hands know that it is often the best time to buy.

But I’m keeping some cash on the sidelines. Right now, I expect the market will get worse before it gets better. I want to be able to take advantage of other opportunities that arise down the road.

Sources:

“Market Call: We’re Near the Peak” Tom Konrad. Alt Energy Stocks. http://www.altenergystocks.com/archives/2009/06/market_call_were_near_the_peak.html

“Questions About Dividend Spook New Flyer Investors. Why I’m Buying” Tom Konrad. Alt Energy Stocks. http://www.altenergystocks.com/archives/2011/06/questions_about_dividend_spook_new_flyer_investors_why_im_buying.html

“The Best Peak Oil Investments Meet the Strong Grid: CVTech Group” Tom Konrad. Alt Energy Stocks. http://www.altenergystocks.com/archives/2010/05/cvtech.html

“Ten Clean Energy Stocks for 2011: Buying Opportunities” Tom Konrad. Alt Energy Stocks. http://www.altenergystocks.com/archives/2011/03/ten_clean_energy_stocks_for_2011_buying_opportunities_1.html

“The Magma/Plutonic Merger” Tom Konrad. Alt Energy Stocks. http://www.altenergystocks.com/archives/2011/04/the_magmaplutonic_merger.html

“An Elephant Hunter Explains Market Dynamics” John Petersen, Alt Energy Stocks. http://www.altenergystocks.com/archives/2011/06/an_elephant_hunter_explains_market_dynamics_1.html

“Blue Mountain Disappoints; Nevada Geothermal Power Looks Like a Takeover Target” Tom Konrad. Alt Energy Stocks. http://www.altenergystocks.com/archives/2011/05/blue_mountain_dissapoints_nevada_geothermal_power_looks_like_a_takeover_target_1.html

“A Profitable Smart Grid Penny Stock Aims for a NASDAQ Listing” Tom Konrad. Alt Energy Stocks. http://www.altenergystocks.com/archives/2011/05/a_profitable_smart_grid_penny_stock_aims_for_a_nasdaq_listing.html

“Canadian Insulation Companies Likely to Benefit from Next Budget” Tom Konrad. Alt Energy Stocks. http://www.altenergystocks.com/archives/2011/04/canadian_insulation_companies_likely_to_benefit_from_next_budget.html

“Ten Clean and Green Energy Stocks for 2011” Tom Konrad. Alt Energy Stocks. http://www.altenergystocks.com/archives/2011/01/ten_clean_and_green_energy_stocks_for_2011_1.html

“American Superconductor: Reading the Tea Leaves” Tom Konrad. Alt Energy Stocks. http://www.altenergystocks.com/archives/2011/04/american_superconductor_reading_the_tea_leaves.html

“Is Sinovel Planning to Replace American Superconductor?” Tom Konrad. Alt Energy Stocks. http://www.altenergystocks.com/archives/2011/05/is_sinovel_planning_to_replace_american_superconductor_1.html

“American Superconductor: Time to Catch a Falling Knife?” Tom Konrad. Alt Energy Stocks.http://www.altenergystocks.com/archives/2011/06/american_superconductor_time_to_catch_a_falling_knife_1.html

“Blue Mountain Disappoints; Nevada Geothermal Power Looks Like a Takeover Target” Tom Konrad. Alt Energy Stocks. http://www.altenergystocks.com/archives/2011/05/blue_mountain_dissapoints_nevada_geothermal_power_looks_like_a_takeover_target_1.html